Why manual invoice processing is costing your business time and money

In today’s competitive market, efficient financial management is key to staying ahead. However, for many companies, outdated and manual accounts payable (AP) processes still dominate, creating hidden costs that hinder growth and productivity. If your business is manually processing invoices, you could be losing significant time and money—resources that could be better spent on strategic initiatives.

In this post, we’ll uncover the true costs of manual invoice processing and why automation is more than just a technological upgrade; it’s an essential step toward sustainable business growth.

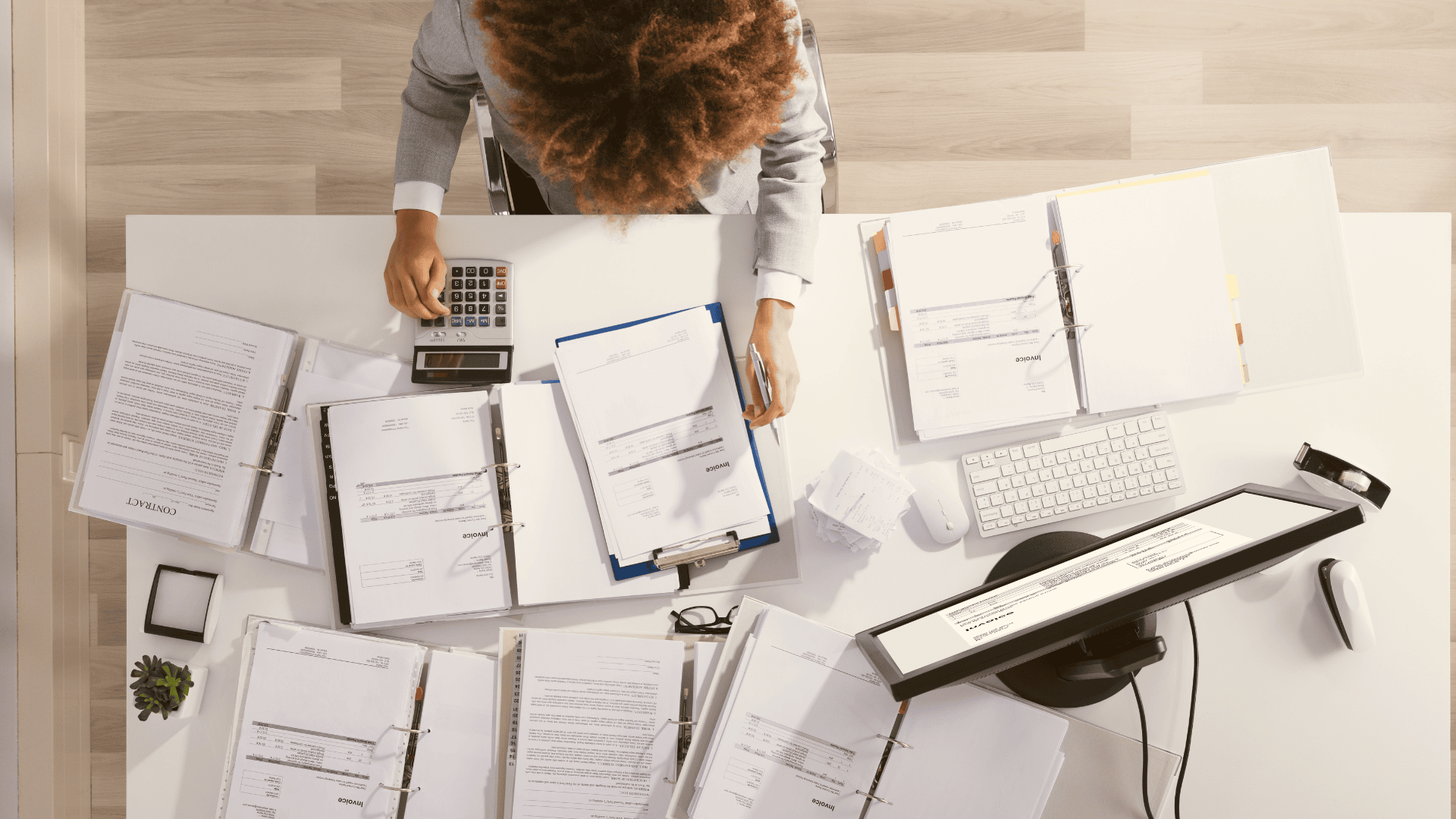

The hidden costs of manual invoice processing

When handling invoices manually, your team has to deal with repetitive tasks like data entry, filing, and approval routing. This process isn’t just time-consuming but also costly. Studies show that manually processing a single paper invoice can cost between €9 and €18, depending on factors like employee wages, infrastructure, and processing time. These costs add up quickly, especially for companies handling thousands of invoices per month.

Let’s break down these expenses:

- Employee time: Processing one invoice takes around 30 minutes, from data entry to approval. For an employee earning €2,000 a month, each hour costs approximately €12.50, meaning processing only one invoice costs about €6.25 per invoice.

- Material and infrastructure costs: In addition to labor, physical invoices require storage space, office supplies, and filing systems, all of which contribute to operational costs. These may seem small individually but become substantial over time.

- Error handling: Manual data entry is prone to errors, which can lead to incorrect payments and damaged vendor relationships. Fixing these errors often requires extra time and resources, further increasing costs.

- Missed discounts and late fees: Inaccurate tracking of invoice due dates leads to missed early payment discounts and late fees, both of which impact cash flow and vendor trust.

These hidden costs quickly add up, making manual invoice processing an expensive and inefficient approach. Beyond the direct financial impact, slow and error-prone workflows can cause issues with vendors and disrupt cash flow.

Fortunately, there’s a way to eliminate these inefficiencies. In the next section, we’ll explore how automation can streamline invoice processing, reduce costs, and improve overall financial management.

The efficiency benefits of automating accounts payable

The cost-saving potential of accounts payable automation is compelling, thanks to a range of sophisticated features that streamline workflows, improve accuracy, and reduce processing costs. Automated AP systems go beyond simple data capture, incorporating technology like AI, machine learning, and multi-device accessibility that free your team from manual tasks and support real-time financial management. Here’s how these features work together to save your business time and money:

- Reduced processing time: Automated systems can process invoices in minutes instead of hours. Using technology like Optical Character Recognition (OCR) and metadata tagging, they quickly capture and organize data, eliminating the need for manual entry and reducing delays.

- Lower error rates with AI and ML: Advanced AP solutions leverage AI and machine learning to enhance data accuracy. These technologies recognize patterns and learn from past entries, minimizing manual input and significantly reducing errors in data extraction and classification.

- Improved cash flow management with real-time integration: Integrating your AP software with eInvoicing, ERP, and document management systems ensures a seamless flow of information. This real-time integration allows your team to track payments and invoices across systems, ensuring on-time payments, which can strengthen supplier relationships and provide cash flow transparency.

- Enhanced productivity through customizable workflows and access control: Automated AP solutions allow for flexible, customizable workflows, streamlining approvals, and simplifying compliance with access controls and security features. By automating routine tasks and enabling secure multi-device access, your team can focus on high-impact projects, enhancing overall productivity.

- Better reporting and decision-making with advanced analytics: AP automation software provides detailed reporting and data export options, empowering your business to track KPIs, analyze vendor spending, and make data-driven decisions. These insights are invaluable for optimizing financial strategies and improving long-term cost efficiency.

Real savings, real impact

Imagine a mid-sized company processing around 5,000 invoices each month. At a manual processing cost of €9 per invoice, this company spends €45,000 monthly, or €540,000 annually, just on invoice processing. With automation, this cost could be cut by up to 80%*, translating to substantial annual savings and freeing up funds for other business needs.

A strategic move toward growth

In a digitally transforming business landscape, automation is no longer optional. Companies that adopt accounts payable automation gain a competitive edge, improving their financial efficiency and setting the foundation for long-term growth. Transitioning from manual to automated AP processing doesn’t just reduce costs—it enhances decision-making, strengthens vendor relationships, and positions your company as an industry leader in efficiency and innovation.

Conclusion

The hidden costs of manual invoice processing can have a significant impact on business efficiency and financial health. By moving towards automation, companies can reduce operational expenses, minimize errors, and streamline processes, ultimately improving overall productivity. As technology continues to evolve, adopting automation is a strategic decision that supports sustainable growth and long-term success.

Sources/references:

- https://porezna.gov.hr/fiskalizacija/bezgotovinski-racuni/bezgotovinski-racuni-novosti/o/ugovaranjem-eracuna-do-usteda-vece-ucinkovitosti

- https://mingo.gov.hr/djelokrug/uprava-za-trgovinu-i-unutarnje-trziste/e-racuni-i-e-trgovina/e-racun-7014/prednosti-uvodjenja-e-racuna/7018

- https://www.m-files.com/resources/case-studies/aluflexpack/