5 signs it’s time to automate your accounts payable process

Introduction

For businesses growing in size and complexity, the accounts payable (AP) process can quickly become a bottleneck. Manual processing slows down your team, delays payments, and can even damage relationships with suppliers. Fortunately, automation can streamline AP tasks, making them faster, more accurate, and scalable as your business grows. But how do you know when it’s time to make the switch?

Here are five signs that it’s time for your business to adopt accounts payable automation.

1. Slow invoice processing is affecting your cash flow

If it takes days or even weeks to process a single invoice, it’s likely slowing down your cash flow and limiting your business’s financial flexibility. Delayed invoice processing can mean missed early payment discounts and a lack of real-time insight into your financial commitments. These delays are clear indicators that your AP process needs a speed boost that only automation can deliver.

Automating AP tasks enables faster invoice approvals, more efficient cash flow management, and a clear view of outstanding payments—keeping your financials running smoothly.

Additionally, finding employees who are willing to do repetitive manual data entry is becoming increasingly difficult. No one wants to spend their work hours on tasks that could easily be automated. People want to focus on smarter, value-driven tasks rather than manually entering invoice details all day.

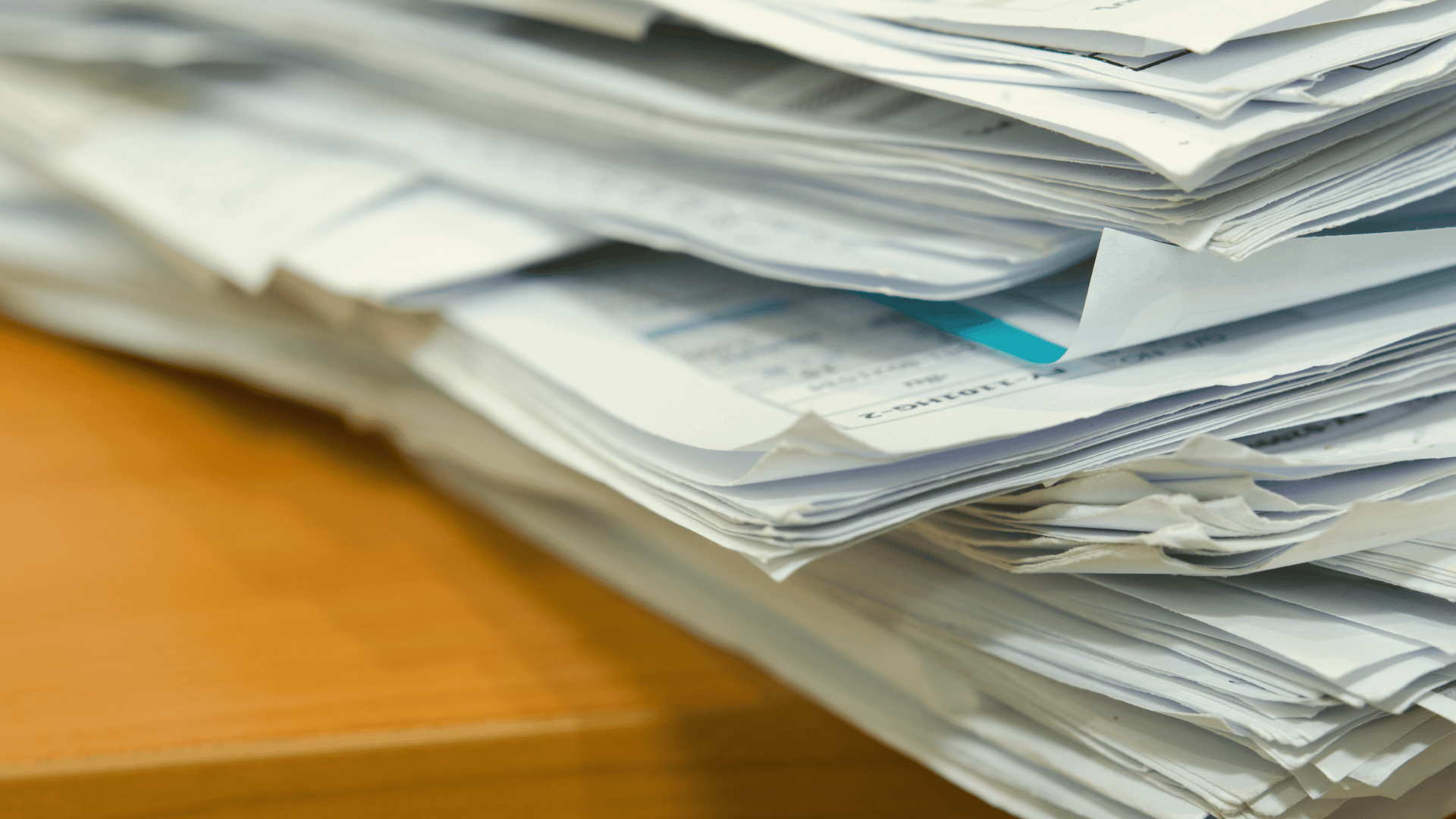

2. Your current process relies on outdated tools

If your AP team still depends on manual data entry or basic tools like OCR without automated approval workflows, you’re only halfway toward full automation. This partial automation might help with data capture, but without automated workflows, approvals and payments remain slow and prone to human error.

A comprehensive AP automation solution allows for streamlined workflows, real-time tracking, and integration with your ERP system, so every step from invoice receipt to payment happens with minimal manual effort.

3. Your business is growing rapidly

As your business scales, so does the volume of invoices. What once was a manageable task can quickly overwhelm a team using manual processes. With growth, the risk of payment delays, data entry errors, and compliance issues also rises. Automated accounts payable systems are designed to scale with your business, allowing your team to handle a higher volume of invoices without sacrificing accuracy or speed.

An AP automation solution provides workflows that adjust to the needs of a growing business, ensuring smooth operations even as complexity increases.

4. Your AP process is decentralized and hard to track

If your accounts payable process involves multiple departments with little centralization, it’s difficult to monitor invoice status or verify that steps are completed. A disconnected system also increases the risk of lost documents and errors, which can delay payments and hurt supplier relationships.

This challenge is even greater for businesses operating as part of a group with multiple companies under one umbrella. Each entity—whether a clinic, a retail location, or a subsidiary—has its own invoices and financial processes. Keeping track of payments across all these entities is nearly impossible without a unified system.

Automation centralizes your AP process, enabling every department to access real-time information. With a centralized digital system, you have full visibility into every stage of the AP workflow, reducing the chance of errors and delays.

5. Frequent late payments are damaging supplier relationships

Late payments don’t just incur penalties; they can also damage relationships with valuable suppliers. When your business frequently misses payment deadlines, it creates a reputation risk that can affect your negotiation power and supplier trust.

Automated AP systems ensure that invoices are processed and approved on time, keeping payments on schedule. This strengthens supplier relationships and can even open opportunities for early payment discounts, which further improves cash flow and lowers operational costs.

Conclusion

If any of these signs sound familiar, it may be time to rethink your accounts payable process. Automation helps businesses reduce errors, improve efficiency, and gain better financial visibility. A modern, digital AP system ensures smoother operations and allows teams to focus on strategic tasks rather than manual data entry.

By recognizing these challenges early, companies can take steps toward a more streamlined and scalable approach to managing their invoices and payments.

Unitfly is a business technology company that helps organizations optimize information management and improve business processes. By understanding each company’s unique challenges, Unitfly creates tailored solutions that enhance efficiency, reduce costs, and ensure better control over critical data.

Contact us today and let’s discuss your business needs and explore the right solution for you.